Difference Between Depreciation and Amortization with Comparison Chart

The cost of business assets can be deducted annually over the asset’s life in order to more properly reflect how they are used. After that, the cost amounts are put to use as a tax deduction, which lowers the company’s tax obligation. Physical assets are subject to wear and tear and their value gets reduced with passage of time. For example, if you buy a new car for $10000 and just take it from the showroom to your home, its value is deemed to have reduced by 5%.

Amortization is a method of spreading payments over several periods, such as a loan or an intangible asset. It is a useful accounting tool for companies to account for the cost of an asset over time instead of paying for it all at once. Intangible assets annual amortization expenses reduce its value on the balance sheet and therefore reduced the amount of total assets in the assets section of a balance sheet.

What is the Journal Entry to Record Depletion of Natural Resources?

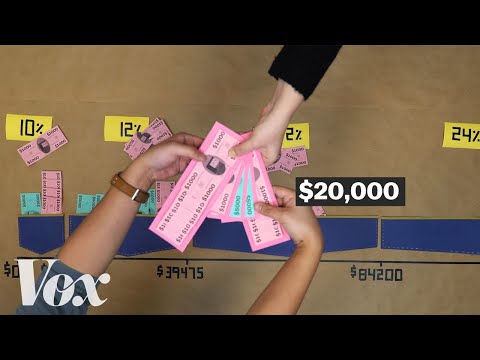

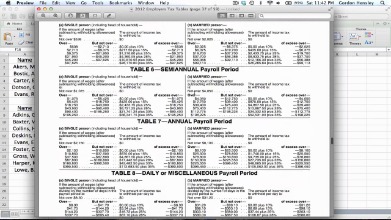

But the real secret sauce is when you develop the understanding of what difference amortization, versus depreciation, makes in your understanding of the business. Conversely, it is more common for depreciation expense to be recognized on an accelerated basis, so that more depreciation is recognized during earlier reporting periods than later reporting periods. For example, a company often must often treat depreciation and amortization as non-cash transactions when preparing their statement of cash flow. Without this level of consideration, a company may find it more difficult to plan for capital expenditures that may require upfront capital. An amortization schedule is often used to calculate a series of loan payments consisting of both principal and interest in each payment, as in the case of a mortgage.

- It is important to note that the choice of amortization method can have a significant impact on a company’s financial statements.

- When it comes to business accounting, there are a lot of terms that get thrown around.

- Additional costs may include sales tax, freight charges, installation fees, testing fees and property swaps.

There are several methods of calculating depreciation, including straight-line depreciation, declining balance depreciation, and sum-of-the-years’ digits depreciation. Each method has its own advantages and disadvantages, and businesses must choose the method that best suits their needs and financial goals. When you invest in tangible business property, you might want to know how depreciation works. This tax treatment allows you to capitalise costs over several years to deduct the amount in the current year. Depreciation is the term used to describe the reduction in the value of plant, property and equipment over their useful lifespan concerning the usage of the asset during the year. Amortization is the process of reducing the cost over the time of an irreplaceable asset.

What Is an Example of Amortization?

This is often because intangible assets do not have a salvage, while physical goods (i.e. old cars can be sold for scrap, outdated buildings can still be occupied) may have residual value. Depreciation is used for tangible assets, or physical assets, like buildings, machinery, equipment, vehicles, and furniture. These assets wear down over time due to physical use and are depreciated to reflect this decrease in value. You can use the acceleration of depreciation or Straight-line methods (SLM) to cover assets, plants and equipment. However, amortization is mainly used to amortize intangible assets by using a straight-line method.

Unlike actual assets, which lose value or wear down with time, loans do not. Loans are also amortised because the initial asset value is largely irrelevant for financial reporting purposes. Despite the possibility of payment history being contained in the notes, a corporation simply needs to disclose its present amount of debt rather than the previous value less than a contra asset. The cost is often divided up as depreciation among the intervals when the asset is anticipated to be employed. The units-of-production method calculates depreciation expenses based on the number of units produced or the usage of the asset.

Depending on what you’re investing in, you may need to understand the declining value of intangible assets, or the way that many loans are structured. Amortize literally means “to kill.” So, as you pay down a loan, you will eventually “kill” it. The other meaning of amortization is the reduction of the cost of an intangible asset over time. A technique used to determine the loss in the value of the long-term fixed tangible asset due to usage, wear and tear, age or change in market conditions is known as depreciation. Long term fixed tangible assets mean the assets which are owned by the company for more than three years, and they can be seen & touched.

What is Depreciation?

The monthly accounting close process for a nonprofit organization involves a series of steps to ensure accurate and up-to-date financial records. The correct way to amortise or depreciate an asset is determined by accounting advice, not a general rule. Both terms stretch the cost of an asset across the course of that asset’s useful life, and neither one provides a corporation with a financial benefit over the other. The simplest way to depreciate an asset is to reduce its value equally over its life.

- Assets owned by the business, such as real estate, tools, structures, buildings, plants, machinery, and cars, can be depreciated.

- Depreciation is applied to fixed assets, which generally experience a loss in their utility over multiple years.

- The balance grows over time so that you owe as much or more than you borrowed at the end.

- Whether it is a company vehicle, goodwill, corporate headquarters, or a patent, that asset may provide benefit to the company over time as opposed to just in the period it is acquired.

- An example of depreciation is the sum-of-the-years digits approach, which accelerates the depreciation of tangible assets like vehicles.

Depending on the type of depreciation, a piece of equipment can be written off as an expense in the first year or written off over 10 years. Your loan details are entered on a separate sheet rather than into a table. You then add up all of your payments and divide them by the total number of months until you reach your repayment goal. You can see what percentage of your monthly payment goes toward the principle and the rest to interest in the schedule. If you are paying off your loan early, you can save money on interest by paying it off early. This has been a guide to the top difference between Depreciation vs Amortization.

Why Is Amortization Important in Accounting

Like amortization, depreciation is used to spread out the cost of an asset over time, but it is only applicable to tangible assets. In a lending context, which you may also encounter as an investor in real estate investment for how to fill in irs form 7004 trusts or mortgage-based investments, amortization is a technique by which loan financing is configured. Like amortization for accounting, the value of an asset decreases over time, but in this case, it’s a loan.

This method reflects the economic value of an asset as it ages, making it less likely to be sold. The straight-line depreciation method is an example of the cost-recovery approach. In this method, the same cost is allocated to an asset throughout its useful life every year. For a small business, depreciation is a method for spreading the cost of a larger asset over several years.

Factors Affecting Depreciation and Amortization Expense

Since tangible assets might have some value at the end of their life, depreciation is calculated by subtracting the asset’s salvage value or resale value from its original cost. In other words, the depreciated amount expensed in each year is a tax deduction for the company until the useful life of the asset has expired. In general, there is accounting guidance provided by GAAP on how to handle various asset categories. Accounting regulations mandate that tangible, physical assets should be depreciated whereas intangible assets should be amortised (with the exception of non-depreciable assets). For tax purposes, depreciation methods and the time frames over which investments are depreciated may differ depending on the type of asset and the firm.

Seazen Group (HKG:1030) Use Of Debt Could Be Considered Risky – Simply Wall St

Seazen Group (HKG: Use Of Debt Could Be Considered Risky.

Posted: Mon, 04 Sep 2023 22:18:26 GMT [source]

This method records the same amount of amortization each year over the asset’s useful life. It is essential to choose the method that best reflects an asset’s usage pattern and benefits over its useful life. Depreciation is allocating the cost of a tangible asset, such as a building, furniture, vehicle, or machinery, over its useful life.

In these cases, there will be a balloon payment due (a large lump sum payment). A partially amortizing loan can be A nightmare for homeowners or companies that are unprepared. An example of the necessity of recording depletion for natural resources can be seen when a forest is clear cut and not replanted.